Affidavit as to Power of Attorney Being in Full Force 2008-2024 free printable template

Show details

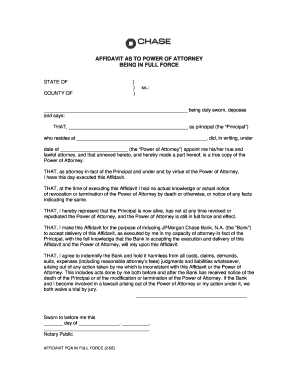

AFFIDAVIT AS TO POWER OF ATTORNEY BEING IN FULL FORCE STATE OF COUNTY OF SS: (TOWN) being duly sworn, deposes and says: That as Principal/Granter did, in writing, under date of (date of Power of Attorney)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your affidavit power attorney full form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit power attorney full form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit power attorney full force online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

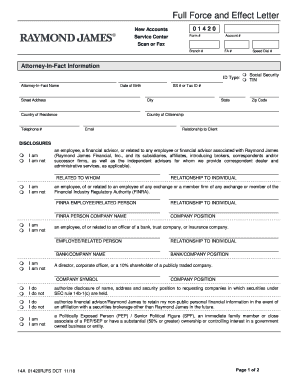

Edit full force and effect letter power of attorney form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out affidavit power attorney full

How to fill out heirs affidavit:

01

Obtain the necessary forms: First, obtain the heirs affidavit form from the appropriate jurisdiction. This form can typically be found online or at the local probate court.

02

Gather required information: Gather all the necessary information needed to complete the affidavit. This may include the deceased person's full name, date of birth, date of death, last known address, and any known surviving relatives.

03

Identify the heirs: Identify all the legal heirs and beneficiaries of the deceased person. This may include spouses, children, parents, siblings, or any other individuals entitled to an inheritance according to applicable laws or the deceased person's will.

04

Provide supporting documentation: Attach any relevant supporting documentation that proves your relationship to the deceased person or your entitlement to inherit. This may include birth certificates, marriage certificates, or wills.

05

Complete the form accurately: Fill out the heirs affidavit form accurately and legibly. Be sure to provide all the requested information and double-check for any errors or omissions.

06

Sign the affidavit: Once the form is complete, sign the affidavit in the presence of a notary public. The notary public will then notarize the document, officially recognizing the authenticity of your signature.

07

Submit the affidavit: Submit the completed and notarized heirs affidavit to the appropriate authority, such as the probate court or executor of the estate. Keep a copy for your records.

Who needs heirs affidavit:

01

Individuals involved in the probate process: An heirs affidavit may be required by individuals involved in the probate process, such as administrators or executors of an estate. It helps establish the legal heirs and beneficiaries entitled to inherit from the deceased person.

02

Those settling the deceased person's estate: Those responsible for settling the deceased person's estate, such as probate attorneys or financial institutions, may also need an heirs affidavit to ensure proper distribution of assets.

03

Beneficiaries and potential heirs: Beneficiaries and potential heirs may need to complete an heirs affidavit to claim their inheritance or establish their right to an estate. This document helps provide proof of their relationship to the deceased person and their entitlement to the assets.

Fill affidavit full form blank : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is heirs affidavit?

An heir's affidavit is a document that is sworn to by a person's heirs that states the facts regarding the distribution of the person's property or assets after their death. It is used to provide evidence that all persons entitled to receive a decedent's estate have been informed of their entitlement and that the estate has been distributed according to the decedent's wishes or applicable state laws.

How to fill out heirs affidavit?

The process of filling out an Heirs Affidavit will vary depending on the specific requirements of the court or other legal document. Generally, however, the following steps should be followed:

1. Gather the necessary information. This will include the name and address of the deceased, the date of death, and information about any assets or debts that may be involved.

2. Fill out the affidavit. The affidavit should include the names and addresses of each heir, as well as a description of the relationship between them and the deceased.

3. Have the affidavit notarized. All affidavits must be notarized in order to be valid.

4. Submit the affidavit to the court or other legal document. This will ensure that the affidavit is officially recognized.

What information must be reported on heirs affidavit?

An heir's affidavit is a sworn statement that is used to prove the identity, relationship, and/or authority of a person or persons to act on behalf of an estate or trust. It must include the following information:

-The full name, address, and date of birth of the person(s) making the statement;

-The name and address of the decedent;

-The relationship of the person(s) making the statement to the decedent;

-The name and address of the estate or trust;

-A detailed description of the authority being given;

-The signatures of the person(s) making the statement; and

-The date the statement was signed.

When is the deadline to file heirs affidavit in 2023?

The exact deadline to file an heir's affidavit in 2023 varies by state. Generally, the deadline is within a few months of the date of death of the decedent, though this can be longer depending on the laws of the state. It is best to consult with an attorney in the state of the decedent's death for more specific information.

Who is required to file heirs affidavit?

The heirs or beneficiaries of an estate are typically required to file an heir's affidavit.

What is the purpose of heirs affidavit?

An heir's affidavit is a legal document that is used to establish the heirs of a deceased person who did not leave a valid will. The purpose of this affidavit is to provide proof of inheritance and to facilitate the transfer of the deceased person's assets and property to their rightful heirs. It serves as a declaration by the individuals named as heirs, stating their relationship to the deceased and their entitlement to inherit the assets. This document helps the probate court or other legal authorities in determining the distribution of the deceased person's estate in the absence of a will.

What is the penalty for the late filing of heirs affidavit?

The penalty for the late filing of an heirs affidavit can vary depending on the jurisdiction and specific laws in place. In some cases, there may be a specific deadline by which the affidavit must be filed, and failure to meet this deadline could result in penalties or consequences.

These penalties can include fines, interest accruals on any outstanding inheritance taxes, or potential legal complications. Additionally, the late filing of an heirs affidavit may cause delays in the distribution of the deceased person's estate and can result in disputes or complications among the inheritors.

It is important to consult with an attorney or legal professional in your jurisdiction to understand the specific penalties and consequences related to the late filing of an heirs affidavit.

How can I manage my affidavit power attorney full force directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your full force and effect letter power of attorney form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send heirs affidavit to be eSigned by others?

Once you are ready to share your affidavit being full form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute affidavit power attorney being full force online?

Filling out and eSigning attorney power act form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Fill out your affidavit power attorney full online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Heirs Affidavit is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit full form

Related to behalf attorney power

If you believe that this page should be taken down, please follow our DMCA take down process

here

.